Economy

Powell Says Soft Landing ‘Very Challenging;’ Recession Possible

Chair says chances of recession are not particularly elevated

Policy makers must be nimble if conditions surprise, he says

Federal Reserve Chair Jerome Powell gave his most explicit acknowledgment to date that steep interest-rate hikes could tip the US economy into recession, saying one is possible and calling a soft landing “very challenging.”

“The other risk, though, is that we would not manage to restore price stability and that we would allow this high inflation to get entrenched in the economy,” Powell told lawmakers on Wednesday. “We can’t fail on that task. We have to get back to 2% inflation.”

The Fed chair was testifying before the Senate Banking Committee during the first of two days of congressional hearings. In his opening remarks, Powell said that officials “anticipate that ongoing rate increases will be appropriate,” to cool the hottest price pressures in 40 years.

“Inflation has obviously surprised to the upside over the past year, and further surprises could be in store. We therefore will need to be nimble in responding to incoming data and the evolving outlook,” said Powell, who appears before the House Financial Services Committee on Thursday.

Buy WSJ Digital Subscription 3 Years WSJ Online Reading Buy Now and Get 70% Off

The Federal Open Market Committee last week raised its benchmark lending rate 75 basis points — the biggest increase since 1994 — to a range of 1.5% to 1.75%. Powell told reporters after the meeting that another 75 basis-point increase, or a 50 basis-point move, was on the table next month. But he made no direct reference to the size of future hikes during Wednesday’s hearing.

The Fed chair faced a barrage of questions about the risk of recession, with economists increasingly flagging the likelihood of a downturn sometime in the next two years. Former New York Fed President Bill Dudley wrote in a Bloomberg Opinion column Wednesday that a recession is “inevitable” within the next 12 to 18 months.

“The American economy is very strong and well positioned to handle tighter monetary policy,” Powell said in his opening remarks. He later said that the Fed is “not trying to provoke and do not think we will need to provoke a recession.”

The Fed chief also said that he did not see the likelihood of a recession as particularly elevated right now, but conceded that it was “certainly a possibility,” noting that recent events have made it harder for the Fed to lower inflation while sustaining a strong labor market.

A soft landing “is our goal. It is going to be very challenging. It has been made significantly more challenging by the events of the last few months — thinking there of the war and of commodities prices and further problems with supply chains.”

Buy WSJ Digital Subscription 5 Years WSJ Online Reading Buy Now and Get 70% Off

“The worry about recession risk is a little more palpable,” said Derek Tang, an economist at LH Meyer, a Washington-based policy-analysis firm. Tang said the message that the Fed isn’t trying to cause a recession — though one could result as it continues to raise rates — “is a very difficult tightrope to walk.”

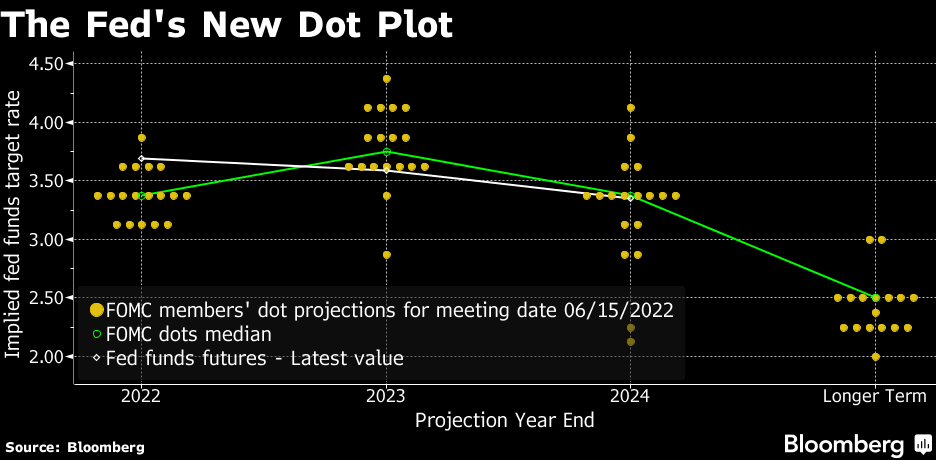

Investors expect the US central bank to keep raising rates to a peak around 3.6% by the middle of next year, according to interest-rate futures.

“Financial conditions have tightened and priced in a string of rate increases and that’s appropriate,” Powell said. “We need to go ahead and have them.”

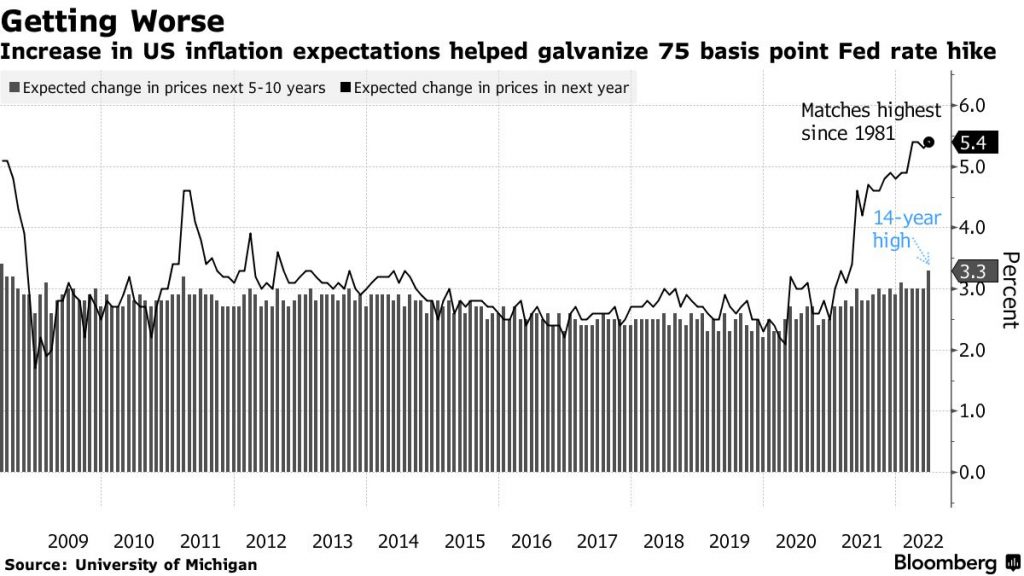

The Labor Department’s consumer price index rose 8.6% last month from a year earlier, a four-decade high. University of Michigan data showed US households expect inflation of 3.3% over the next five to 10 years, the most since 2008 and up from 3% in May.

WSJ And Barrons News Digital Combo Offer 5 Years Buy Now

The rising cost of living has angered Americans and hurt the standing of President Joe Biden’s Democrats with voters ahead of November congressional midterm elections.

Powell heard sharp criticism of his performance on inflation, especially from Republicans, with Alabama Senator Richard Shelby telling him that “the Federal Reserve failed the American people.”

Fed officials have admitted that they were too slow to tighten and are now trying to front-load rate increases in the most aggressive policy pivot in decades.

Concern over the outlook for global growth has seen oil prices ease back somewhat in the last few days, potentially providing some relief to sky-high gasoline prices. At the same time, US hiring remains strong and consumption indicators suggest demand is holding up despite the blow to real disposable income from higher inflation.

Policy makers’ latest forecasts, released last week, show the level of rates roughly doubling in the second half of the year to a target range of 3.25% to 3.5%. They saw rates peaking next year at 3.8%.

Officials have also begun shrinking their massive balance sheet. The combined impact of higher borrowing costs and so-called quantitative tightening is expected to come at some cost to jobs.

Unemployment was near a 50-year low of 3.6% last month and Fed officials forecast it rising to 4.1% by the end of 2024, when they see rates peaking at 3.8%. Inflation was projected to decline toward their 2% goal by then from current readings of more than three times that level, according to the gauge that the Fed targets.

Forward guidance from officials on the future path of policy, as well as the rate increases they’ve already delivered, have helped push 10-year Treasury yields above 3%, about double from the start of the year, while the S&P 500 stock index is down more than 20%. Surging mortgage rates are helping to cool the housing market.